Austin Medicaid & Medicare Fraud Lawyer

Facing a Medicare or Medicaid fraud charge can be deeply troubling. The consequences of a conviction are serious and can include heavy fines and prison time. Understanding your legal situation is crucial.

Facing Medicare or Medicaid fraud charges? Get a tough defense from Cofer & Connelly, PLLC. With 100 years of combined experience and over 300 trials, we know how to fight for you. Call (512) 991-0576 or contact us online to consult with a Medicare/Medicaid fraud attorney in Austin.

What is Medicare and Medicaid?

Medicare is a health insurance program primarily for people aged 65 and up, although it also covers younger people with certain diseases or disabilities. It consists of several parts: Part A covers hospital stays and some home health care, Part B covers doctor visits and outpatient services, and Part D helps with prescription drug costs. Additionally, Medicare Advantage (Part C) plans, offered by private companies approved by Medicare, often include extra benefits and can be a good choice depending on your needs. Understanding Medicare is crucial as you age because it can significantly impact your health care options and expenses. It’s important to review your options annually, as your health needs might change.

In Texas, Medicaid provides health coverage to lower-income adults, pregnant women, children elderly adults, and those with disabilities. Administered by the Texas Health and Human Services Commission, it helps cover medical costs for those who may not afford health care otherwise. Additionally, the Texas Health Insurance Premium Payment Program (HIPP) helps Medicaid recipients pay for private health insurance when it’s cost-effective, reimbursing the cost of premiums if this option is cheaper than direct Medicaid coverage. These state programs are designed to ensure Texas residents have access to affordable health care, supplementing the federal Medicare program, especially for those with lower incomes or specific health needs.

What is Medicare Fraud?

Medicare fraud in Texas refers to actions where someone dishonestly claims Medicare health care reimbursements they are not entitled to. This can be done by providing false information, such as billing for medical services that were never provided or inflating the cost of services. It also includes using someone else's Medicare information to receive medical services or equipment.

Medicaid fraud occurs when individuals or healthcare providers dishonestly claim Medicaid funds or services they're not entitled to. Imagine a doctor charging Medicaid for X-rays or blood tests that were never performed, or diagnosing a patient with a condition they don't have to justify unnecessary tests. Or consider an ambulance company that transports patients who can easily walk on their own but uses an ambulance unnecessarily. Other examples include an individual lying about their financial status to obtain benefits, or a nursing home bookkeeper stealing money from resident trust funds, a pharmacist dispensing a cheaper generic drug but billing for a more expensive brand-name medication, a home health agency billing for care not provided or for patients who are no longer eligible, an orthodontist claiming payment for braces never fitted, or a health clinic charging patients for services already covered by Medicaid.

What Are the Penalties for Medicare Fraud?

The penalties for Medicare fraud in Texas vary based on the amount involved. For smaller amounts, less than $100, the charge is a Class C misdemeanor, which could result in a fine of up to $500. If the fraud involves $100 to $750, it becomes a Class B misdemeanor, punishable by up to 180 days in jail, a fine of up to $2,000, or both. For amounts ranging from $750 to $2,500, you could face a Class A misdemeanor, which could lead to a year in jail and a fine of up to $4,000.

As the amounts increase, so do the penalties. Fraud involving $2,500 to $30,000 is classified as a state jail felony that is punishable by 6 months to 2 years in jail and up to a $10,000 fine. If the amount is between $30,000 and $150,000, it's considered a third-degree felony, which can result in 2 to 10 years in prison and a fine up to $10,000. For $150,000 to $300,000, the charge is a second-degree felony that is punishable by 2 to 20 years in prison and up to a $10,000 fine. The most severe cases, involving $300,000 or more, are first-degree felonies, which could lead to 5 years to life in prison and up to a $10,000 fine.

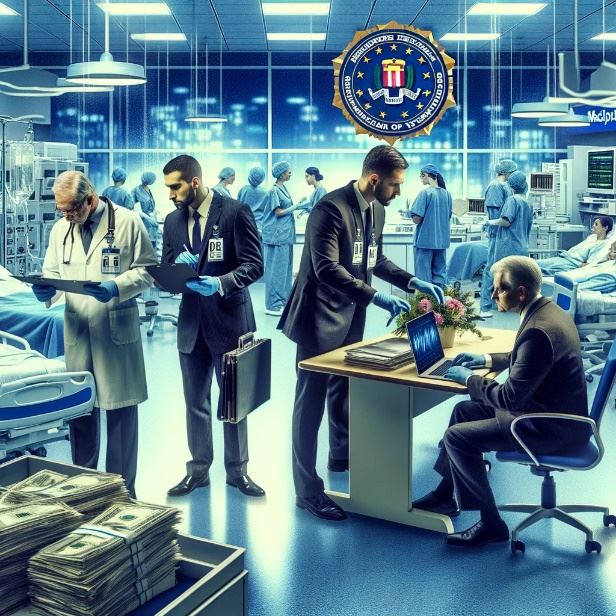

Investigation of Medicare Fraud Charges

When you are facing Medicare fraud charges, it's important to understand how these cases are looked into, both on a federal level and a state level.

At the federal level, the main body investigating Medicare fraud is the Federal Bureau of Investigation (FBI). The FBI works with other federal, state, and local agencies to track down and stop fraud. They focus on providers, patients, and others who might try to trick the health care system to get money or benefits they aren't supposed to have. They look into things like doctors charging for services that were never given or billing for more expensive services than those actually provided.

FBI collaborates with the Department of Justice (DOJ), particularly through Health Care Fraud Strike Forces located across various regions known for significant healthcare fraud activities. These strike forces utilize advanced data analysis and investigative techniques to uncover fraudulent activities.

When someone reports a suspicion of Medicare fraud, the FBI, along with the DOJ and sometimes in partnership with the Department of Health and Human Services’ Office of Inspector General (HHS-OIG), begins an investigation. They examine the healthcare provider’s billing practices, the medical necessity of the services billed, and the actual services provided. If these agencies find substantial evidence of wrongdoing, the DOJ will handle the prosecution.

On the state level, especially in places like Texas, the Medicaid Fraud Control Unit, which is part of the Office of the Attorney General, takes the lead. State investigations are typically triggered by unusual billing patterns or tips from informants. State investigators review billing data, patient records, and may conduct interviews with staff and patients. They focus on identifying whether Medicaid has been billed for services that were never provided or if there has been any overcharging. If they find fraud or abuse, they work with local and federal authorities to bring charges.

Both federal and state investigations might include checking financial records, interviewing witnesses, and partnering with other law enforcement groups. For example, in Texas, the Strike Force teams up with U.S. Attorney’s Offices and other agencies to crack down on complex fraud cases involving prescription drugs, genetic testing, and more.

What You Should Do If Accused

- Respond Promptly: If you are notified of an investigation, it's vital to respond promptly and cooperate with investigators, while also protecting your legal rights.

- Understand Your Rights: You have the right to know the details of the accusations against you. You can request this information from the investigating agency.

- Consult a Lawyer: An experienced health care fraud lawyer can help you with the investigation process, represent your interests, and develop a defense strategy.

- Gather Documentation: Compile all relevant documents, including billing records, patient records, correspondence with Medicare or Medicaid, and any other paperwork that could support your case.

- Prepare for Interviews: If you agree to participate in interviews, prepare thoroughly. Understand what information you are required to provide and consider having a Medicaid / Medicare fraud lawyer present during these discussions.

Being accused of Medicare or Medicaid fraud is a serious matter. Understanding how investigations are conducted and taking proactive steps can significantly impact the outcome of your case.

Potential Defenses in Medicare and Medicaid Fraud Cases

There are several defenses your Medicaid / Medicare fraud attorney might consider based on your specific situation. One common defense is the lack of intent. In other words, you did not intend to defraud anyone; perhaps there was a misunderstanding or a mistake in billing or coding that led to the charges. This could show that no errors were made on purpose.

Another possible defense is the right to rely on professional advice. If you followed the direction of someone else who seemed to be an expert, like a billing consultant or another healthcare provider, you might argue that you were doing what you were advised and believed it was correct.

Entitlement to payment is another defense. This means you believed you were rightfully claiming payments for services genuinely provided. If you can show that the services billed were actually provided as stated, this could be a strong defense against the fraud charges.

Role of a Medicare / Medicaid Fraud Lawyer

When you’re charged with Medicare fraud, a criminal defense lawyer plays a crucial role in your case. They will look closely at the charges against you and the evidence. Your lawyer will fight to protect your rights throughout the process and work to present your side of the story effectively.

Your lawyer will handle all the legal filings and deadlines and represent you in court. They’ll also negotiate with prosecutors, possibly reducing your charges or penalties. More importantly, they’ll develop a defense strategy tailored to your situation, aiming to achieve the best possible outcome, whether that's proving your innocence or minimizing potential penalties.

Your lawyer’s role is to provide you with guidance and clear explanations about your legal options and the possible outcomes of your case.

Call an Austin Medicare Fraud Attorney Today

If you're facing charges for Medicare or Medicaid fraud, you need the right team to defend your rights and guide you through the legal process. Clients come to Cofer & Connelly, PLLC for strong criminal defense backed by 100 years of experience, over 25,000 cases, and more than 300 trials in Texas courts. Contact Cofer & Connelly, PLLC by calling (512) 991-0576 or contacting us online for a consultation with a Medicaid / Medicare fraud attorney. Our experienced criminal defense lawyers in Austin understand the complexity of these charges and are ready to help protect your future.

-

"Excellent all around. Highly recommend."W. N.

-

"I am eternally grateful for all of the efforts they put in to go above and beyond for everyone they help."Former Client

-

"They really listen to and care about their client's needs and consistently fight for the best outcome! I am eternally grateful for all of the effort they put in to go above and beyond for everyone they help."C.D.

-

103 Years of Experience

-

32,000 Cases

-

357 Trials